For example, if the property is on the verge of total deterioration, investing in capital expenditures probably isn’t the best use of time and money. Also, you may want to consider the age and condition of your property to estimate its remaining lifespan. The most important step in budgeting for CapEx is determining which investments will maximize the profit and value of your property in the long run. As a property manager or owner, it’s crucial to improve your financial literacy by distinguishing between capital expenditures and operating expenses, planning for CapEx, and determining which CapEx is worthwhile. Now that we’ve explained real estate CapEx in great detail, let’s discuss some helpful tips for budgeting and planning for these expenditures. Namely, the IRS allows businesses to deduct operating expenses from their tax forms, whereas capital expenditures are taxable. Operating expenses for properties include:Īdditionally, the IRS also views operating expenses differently from capital expenditures. They’re expenses necessary for operating and maintaining the property regularly. OpEx is routine expenses that help manage a property, such as paying property staff, property taxes, and legal fees. capital expendituresĪlthough operating expenses (OpEx) and capital expenditures can seem similar, they’re entirely separate from each other. See how investing in ButterflyMX improves the resident experience: Unlike routine repairs, CapEx significantly improves the property conditions or extends its lifespan - they do more than simply return the property to its original state.

It’s important to note that a capital expenditure must be a big enough purchase or project that it’s expected to depreciate over time. Implementing a new building automation system.

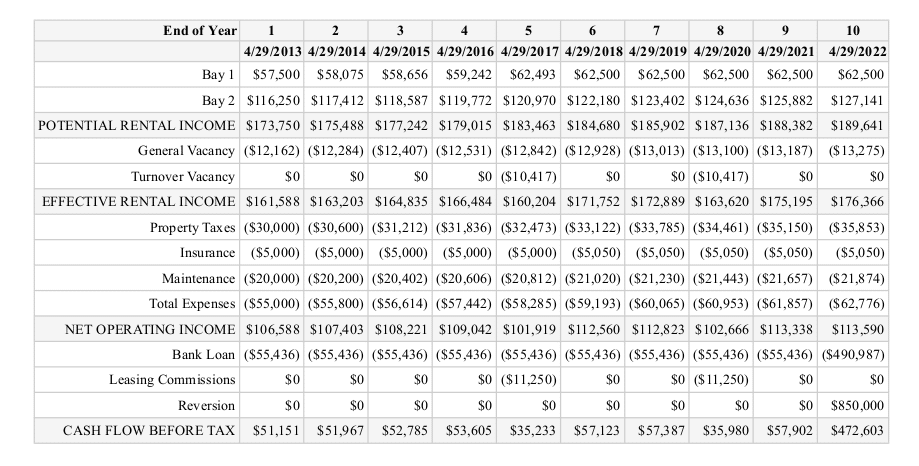

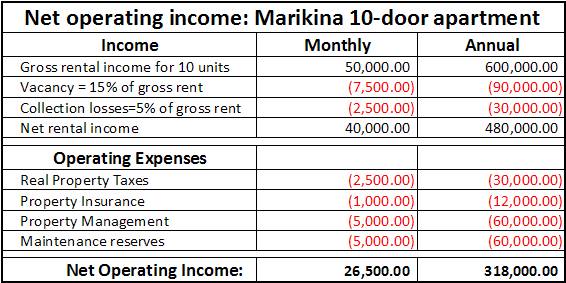

PP&E is the change in property, plant, and equipment in the current period from the prior. The following is the formula for calculating CapEx: And if the good or service has a useful life of less than one year, it has to be expensed on the income statement - it cannot be considered as CapEx. Overall, the purpose of CapEx is to increase the scope and efficiency of the business operation, in turn adding economic value to the organization. As a result, CapEx also isn’t factored in when calculating a property’s capitalization rate. This means that CapEx is not expensed on monthly or annual income statements. Unlike operational expenses (which are used to calculate your NOI), capital expenditures are recorded - or capitalized - on balance sheets. Companies often use CapEx to embark on new projects or investments. Tips for planning and budgeting for CapExĬapital expenditures (CapEx) are spendings used by real estate companies to invest, purchase, renovate, and maintain physical assets such as properties, technology, or equipment.These expenses are known as capital expenditures, more commonly known as CapEx.īut how do you decide which expenses are worth it? In this post, we do a deep dive into CapEx real estate, provide tips for budgeting for it, and explain why property technology (proptech) is a good use for it. In addition to normal operating expenses, you may need to invest in “big ticket” items to maintain and enhance your property. As a property manager or owner, you know that buildings require maintenance, renovations, and appliance replacements or upgrades.

0 kommentar(er)

0 kommentar(er)